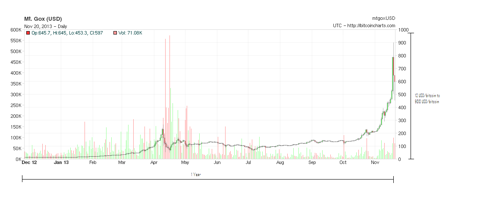

Remember the most important rule in spotting a bubble: "90% of the move comes in the last 10% of the time".

In a year, Bitcoin soared from 12 USD/bitcoin to 1000 USD/bitcoin. In total we have a rise of 1000 - 12 = 988 USD/bitcoin.

10% of 1 year = a little over 1 month. The price was 180 USD/bitcoin a month earlier. So in the last month, bitcoin soared from 180 USD/bitcoin to 1000 USD/bitcoin. That's a 820 USD/bitcoin increase in the last 10% of the time frame of 1 year. 820 USD/bitcoin is also almost 90% of 1000 USD/bitcoin.

So in theory: "90% of the move (820 USD/bitcoin) comes in the last 10% of the time (one month)."

Which means, the bubble should now burst if I'm right...

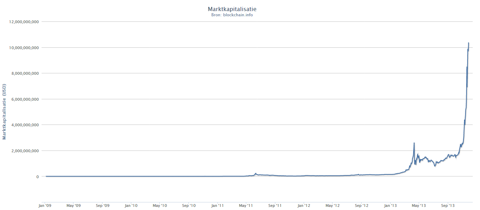

Moreover, as silver and gold continue their downward spiral, bitcoin continues surging. At this rate for example, we have a $20 billion silver market (above ground silver) and a $12 billion bitcoin market.

At some point very soon, the bitcoin market will overtake the silver market.

You can physically buy up every ounce of silver in this world with bitcoins, by just going to this site for example: http://bitcoincommodities.com/

Eventually these people need to do something with their bitcoins. Why wouldn't they buy up the entire silver market?

Additionally, this week we finally crossed the line where 1 Bitcoin costs the same as an ounce of gold. One Bitcoin costs $1230.

If you could choose between a Bitcoin or gold coin, I would certainly go for the gold coin and here is why.

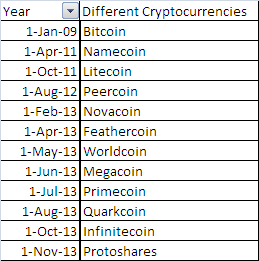

First, we had Bitcoin (2008), then we had Namecoin (18-Apr-2011), Litecoin (7-Oct-2011) and now we have Peercoin 12-Aug-2012 and Primecoin (7-Jul-2013) and Feathercoin (16-Apr-2013) and Novacoin (9-Feb-2013) and many more to come.

If everyone invents new coins, there is only so much money that people can use to buy these coins. At some point we will get a crash in the value of these coins as more and more coins come out of nowhere.

The following site gives a list of the most important cryptocoins:

http://coinmarketcap.com/

To show you why I think Bitcoin is a bubble I took the cryptocurrencies with the highest market cap in this table.

You can see that we first had Bitcoin in 2009 and as we progress, more and more competing cryptocurrencies arose.

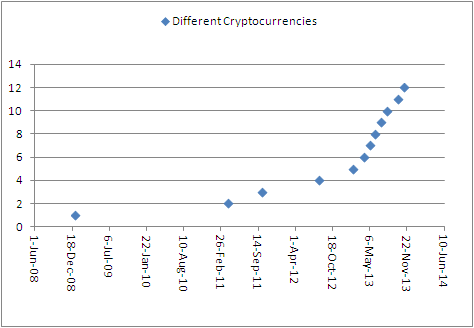

It gives us this chart:

More and more "bitcoins" emerge out of nowhere and that's why I think we will see Bitcoins implode at some point. This parabolic curve is the physical evidence of a bubble.

Second, Bitcoin's use is mostly speculative, you don't buy Bitcoin because you think it has value. People buy it to earn speculative profit from it. That's the biggest difference as opposed to gold. Also, you can't buy a lot with Bitcoin today. The most important retailers like Google, Amazon and eBay have their own payment system.

Third, gold has an intrinsic value while Bitcoins don't have an intrinsic value. Gold can never be duplicated and it is very difficult to mine it out of the ground. Also, gold is a universally accepted "currency", with an above ground stock of 170000 tonnes or a market capitalization of $7.5 trillion. If you know that the amount of U.S. dollars in this world is about $10 trillion (M2 money supply), then you can easily see that gold is competing with fiat currency. Now if we look at the tiny market capitalization of Bitcoin, we only have $12 billion. So the Bitcoin world is only 0.16% of the gold market. People would argue that this means that Bitcoin has much room to grow because of this difference in market capitalization. If you believe Bitcoin can compete with gold, then Bitcoin would need to go up a thousand times from its level today. I don't believe this will happen because of the reasons I pointed out earlier.

Conclusion:

Unlike Bitcoins, gold cannot be duplicated, nor can it be invented out of nowhere. I'd just stay with physical gold (GLD) (PHYS).

Geen opmerkingen:

Een reactie posten