Interesting article that says that it isn't actually Belgium that is buying the U.S. debt. Belgium is actually just an offshore account for foreigners to buy U.S. debt via the banking system.

For what I know, the Fed could even be buying its own U.S. bonds via Belgium.

If this is true, then the Fed isn't tapering at all if you count the numbers...

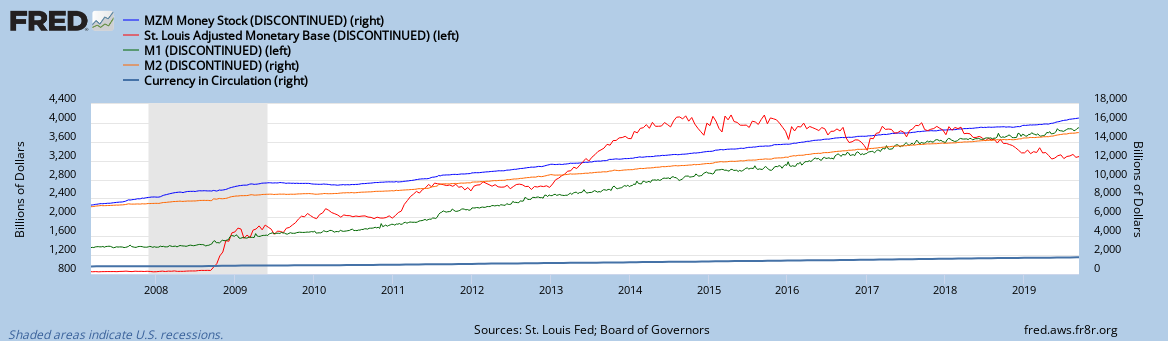

Because why is base money supply (red chart) growing at an even higher pace?

Creditor Name: Belgium

Amount of U.S. Debt Owned (January 2013): $143.5 billion

Percent of U.S. Public Debt (January 2013): 1.24 percent

We know what you're thinking: Belgium? Really? The gross domestic product (GDP) of this small European nation tucked between France, Germany and the Netherlands ranks No. 32 in the world, behind Nigeria and Malaysia [source: CIA World Factbook]. So why is Belgium one of the top 10 purchasers of U.S. debt?

The secret is something called "custodial bias" [source: U.S. Treasury]. Belgium has made a name for itself as one of Europe's most vibrant international banking centers. Like Switzerland, bank accounts in Belgium historically offered a high degree of secrecy, although that changed in 2011 when the Belgian government began disclosing account information to improve tax transparency [source: Hyslop]. Still, Belgium offers big tax breaks for foreign companies that create Belgian subsidiaries and benefits for investors who choose Belgium for offshore accounts [source: Henley].

Belgium's status as a tax haven makes it a popular place to buy U.S. debt, even if the investors aren't from Belgium. The U.S. Treasury tracks purchases of U.S. debt by geographic origin, not the specific nationality of the buyer [source: U.S. Treasury]. This is where custodial bias distorts the debt figures. Belgium is a custodian (or holder) of U.S. debt from investors living in nearby France and Germany or as far away as China and Japan. How much of that debt is owned by actual Belgians is difficult to tell.

We'll talk more about custodial bias with our next entry: teeny tiny Luxembourg.

For what I know, the Fed could even be buying its own U.S. bonds via Belgium.

If this is true, then the Fed isn't tapering at all if you count the numbers...

Because why is base money supply (red chart) growing at an even higher pace?

Creditor Name: Belgium

Amount of U.S. Debt Owned (January 2013): $143.5 billion

Percent of U.S. Public Debt (January 2013): 1.24 percent

We know what you're thinking: Belgium? Really? The gross domestic product (GDP) of this small European nation tucked between France, Germany and the Netherlands ranks No. 32 in the world, behind Nigeria and Malaysia [source: CIA World Factbook]. So why is Belgium one of the top 10 purchasers of U.S. debt?

The secret is something called "custodial bias" [source: U.S. Treasury]. Belgium has made a name for itself as one of Europe's most vibrant international banking centers. Like Switzerland, bank accounts in Belgium historically offered a high degree of secrecy, although that changed in 2011 when the Belgian government began disclosing account information to improve tax transparency [source: Hyslop]. Still, Belgium offers big tax breaks for foreign companies that create Belgian subsidiaries and benefits for investors who choose Belgium for offshore accounts [source: Henley].

Belgium's status as a tax haven makes it a popular place to buy U.S. debt, even if the investors aren't from Belgium. The U.S. Treasury tracks purchases of U.S. debt by geographic origin, not the specific nationality of the buyer [source: U.S. Treasury]. This is where custodial bias distorts the debt figures. Belgium is a custodian (or holder) of U.S. debt from investors living in nearby France and Germany or as far away as China and Japan. How much of that debt is owned by actual Belgians is difficult to tell.

We'll talk more about custodial bias with our next entry: teeny tiny Luxembourg.

Geen opmerkingen:

Een reactie posten